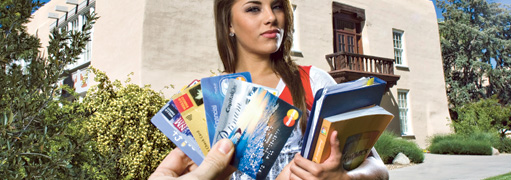

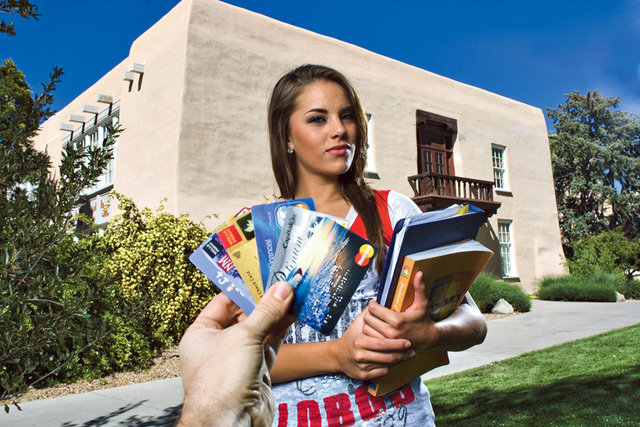

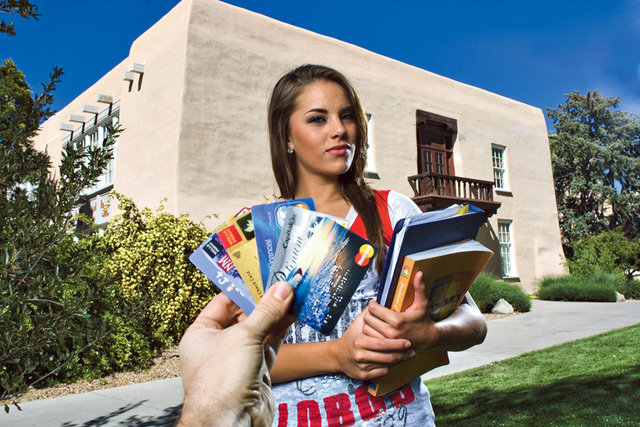

Will A New Law Protect Students From Predatory Credit Card Companies?

Model: Jessica Martin

Eric Williams ericwphoto.com

Latest Article|September 3, 2020|Free

::Making Grown Men Cry Since 1992

Model: Jessica Martin

Eric Williams ericwphoto.com