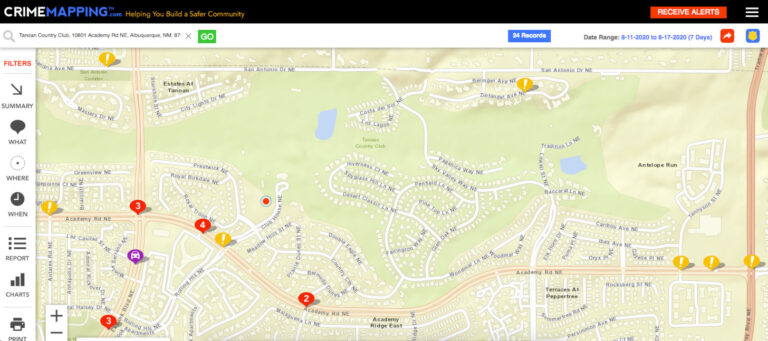

When it’s in the mailbox, ornamenting the roadside and drenching most of our entertainment, it doesn’t take long to recognize a labyrinthine media barrage promoting endless and conspicuous consumption. We are what we buy, and in a free market society where business doesn’t always live by the golden rule, when others win when you lose, it’s easy to find yourself burned. Often that burn comes by way of incinerating little pieces of hologram-emblazed plastic–using fake money like it’s real. With all of the trickery and confusion consumers face in the morass of cash, credit and debt, the ultimate conclusion is that we each have to be our own Theseus, slaying the minotaur and escaping the maze with our minds and money intact.The concept of financial literacy–whether or not an individual is capable of making effective decisions about money–is basic. Despite the many steps taken to prepare children for the world, in the past several decades money management has been understressed within U.S. educational systems. Widespread individual debt is a testament to that. According to Demos, a nonpartisan public policy research and advocacy group, consumer debt in the U.S. more than tripled from $238 billion to $735 billion between 1990 and 2003, while savings have reached a record low.Law professor, bankruptcy scholar and financial literacy educator Nathalie Martin is keenly aware of the trend. She’s been teaching and doing research at UNM since 1998, and prior to her time at the university she spent a decade in private practice. She has discussed bankruptcy on both high-profile television news networks and in newspapers. Firmly in favor of a lifestyle supported by cash and not credit, Martin exposes law students and undergrads in her financial literacy course to the sometimes harsh implications of the use of consumer credit, as well as how to avoid getting ripped off. Here the Alibi talks with her about the credit game, and how people can get out. How did you get involved in teaching financial literacy? I was a bankruptcy attorney and represented mostly huge companies, but I was also exposed to quite a few individuals who had financial problems. When I became a law professor and started working in our legal clinic, we had a lot of clients having personal financial problems. I became really interested, not so much in the bankruptcy and what you do with someone who already has a lot of financial problems, but in how people got that way. In the debtor-creditor world there are two conflicting philosophies about why Americans are so in debt: One is to blame the people who take out the debt and say it’s a lack of personal responsibility. The other side is that we have a totally deregulated credit market, meaning there used to be caps on interest rates and things like that, but we don’t have them now. We have a very, very laissez-faire economy. So the other side of the story is that creditors give way too much credit to people they know will never be able to pay it back. And so, if you come from that camp, you believe a lot of the responsibility for the mess now lies on the creditors. My idea is that it doesn’t matter whose fault it is, we just have to do something about it. Financial literacy seems like a new concept in education. What caused this idea to emerge? First of all, in the past everybody used to learn this, so there’s also the question of what happened to it? Why did we stop teaching it? Now it’s re-emerging, I think, because the level of indebtedness is just so much higher than it’s ever been, and credit is being offered to people who definitely can’t pay it back. I get the feeling that this kind of dire personal financial landscape benefits the financial institutions and the crediting industry in general. Would you agree with that? Absolutely. It definitely benefits those credit industries. I think it’s basic economics 101 that the more consumers spend in general, the healthier the economy is. What we aren’t told is while that may be good for the overall economy, it’s really horrible for the individual people. I find it interesting that people who are really knowledgeable about these matters are happy to tell others to spend money. For example, after 9/11, telling people to go out and shop to support our economy. But the people who really understand the markets don’t use a lot of really expensive consumer credit themselves. It seems like there are a lot of different ideas and self-help books about how to manage personal finance. How does the layman decipher all of this stuff to figure out the right advice? The main thing I see, before you even get into the question of how to build wealth, is that people should try not to use consumer credit. They should really try to go onto a lifestyle that can be supported by cash, and I think that is extremely counterculture right now–people think they should use credit. Credit is expensive, and it’s addictive. So that’s the first thing, and it’s just the easiest principle in the world: You don’t buy things you can’t afford. You get a job, you save money and you use that money to buy things. How is debt perpetuated? People now think–particularly younger people–that there’s no reason to wait. Get whatever you want right now, and pay for it later. But you pay for it two or three times, sometimes more depending on the kind of credit you use. I think the culture perpetuates it. You receive thousands of messages–from the radio, to TV, to billboards, to every time you walk through a store–telling you to buy all these things you really don’t need, that you won’t remember buying half the time. I think it’s a big cultural change we have seen in this country in the last 10 years or so. So that’s what I’m always fighting against–this really strong culture of defining ourselves through our possessions and immediate gratification. How does the consumer fight back? I know this is not what people want to hear, but you fight back by saying, "I’m not going to participate in this." If you already have a lot of charges on your credit card, get it paid off and just vow to stay away. The other thing you can do is never carry a balance. By the time you get to be my age, I’m 46, you know how to use a credit card without ever being charged. The main thing is that you just pay it off before it’s due. I find that a lot of younger people aren’t able to do it. They see the thing they want, and they want to buy it. There are lots of behavioral economic studies showing that people pay more, even per transaction, when they’re using a credit card. If you’re up at Burlington Coat Factory, and you’ve got three items and you have cash, you’re not going to pick up that fourth item that’s sitting right there at the cash register. But if you’re using a credit card you are, because in your mind there’s no finite limit. You can just have whatever you want. Like an idea of free money? Yeah, free money–and the credit card companies certainly want you to think it’s free, too. But the last thing they want is for you to pay it all back on time; you don’t make any money that way. They want people to fail. When it comes to debt collection, what are some of the common practices creditors might use that may not be entirely legal? Well, that’s the other problem. The laws for debt collectors are terrible. There are laws saying you’re not allowed to harass people, you’re not allowed to call them past nine o’clock at night, you’re not allowed to call them at their job. Now check this out: Those laws only apply to debt collection agencies, they do not apply to the original creditor. So we had a client in the clinic–the creditor was Wells Fargo–and she held a car loan. They called her at work, they screamed and yelled at her and said they were going to take her kid and just did horrible things to her. The problem is the creditor who’s holding the loan, who’s owed the money, is allowed to do all that. If they hire a third-party debt collection agency, the debt collection agency can’t do that, but the creditor can harass. They’re legally permitted to. It seems like the whole idea of predatory lending is that it’s aimed at people of lower socio-economic status and minorities. What are people who are not in the crediting industry trying to do about this? There are a number of things going on. There’s a lot of legislation [ the Fair Lending Center is] thinking about for the sub-prime market. These sub-prime mortgages, they’re really high interest rates and they’re adjustable. It is the most evil thing that’s happened to Americans in a long time. Fixed-rate mortgages are great–you know how much you have to pay for the rest of your life. But these predatory loans are targeted to lower income people and minorities. Some studies have shown that as many as 80 percent of these people could have qualified for a conventional loan–that’s really sick, you know? So we have some pretty active groups. What I am doing is this education thing. I’m figuring that rather than trying to get the laws changed, which has been seeming impossible under the current political climate, I would just work on it on the education side. What is going on at the state level? I think statewide we’re in bad shape: We come off as one of the best places for predatory lenders. Lots of poor people, many people of color. This is a real heyday for people who take advantage of others. What bothers me is that these are national companies. All this money they’re making is being taken right out of New Mexico, and this is bad for everybody. It seems like the only logical explanation for why this happens is because it benefits the businesses, and it’s the laissez-faire economy you mentioned. But see, there’s a huge other side to this you should at least know about, which is that some people really believe this is the true democratization of credit. [They believe] people who use these credit products and these horrible mortgages are getting into homes they wouldn’t otherwise get into and are able to buy things they wouldn’t otherwise be able to buy. Somehow, even though this is really, really costly, at least it allows more people to gain access to credit. I think this is absolute nonsense myself, but that’s what you hear. It’s paternalistic to tell people they can’t have nice things and buy on credit just because they are in the lower economic rung. When is it ideal for someone to go bankrupt? Bankruptcy is now harder to access, the laws are now more stringent, but for an individual the time you want to do it is when you’ve literally reached the absolute rock bottom and you’re on your way back up. Because this is not going to put money on the table. It’s going to deal with the past, not the future. So you have to be in a situation where you’re at the very rock bottom, and you’re willing to give up consumer credit for a while, because the worst thing you can do is get back into that game. What are some things debtors typically don’t know but should? People have to face the fact that they are never, ever going to gain any wealth. We’ve only talked about the debt thing, right? But if you think about compounding interest, if you’re the one who has the money, you can make a ton of money. You can turn $100,000 into $200,000 without lifting a finger in seven years (in a 10 percent investment). That’s why in my class I start with that. I want people to know they are never going to have any money as long as they carry these balances on credit cards. So what are some things people should know? They shouldn’t buy things they don’t have money to buy. They should pay for everything with cash, except for a house. I’m not even that crazy about car loans. The main thing is to try not to buy into it and recognize it’s for someone else’s benefit, every bit of it.

Escape The Labyrinth

Whether you’re in debt or just financially confused, here’s a selection of links to help you get in the clear.

Resources on Lending

Center For Responsible Lending

www.responsiblelending.org/consumers

Acorn Housing

www.acornhousing.org/TEXT/predlend.php

Demos

www.demos.org/page37.cfm

FTC Bureau of Consumer Protection

www.ftc.gov/bcp/menus/consumer/credit.shtm

Resources for Credit Counseling

National Foundation For Credit Counseling

www.nfcc.org

Consumer Credit Counseling Service (CCCS) Southwest

www.cccssouthwest.org, (866) 889-9347

Warning About Debt Consolidation

www.daveramsey.com/the_truth_about/debt_consolidation_3035.html.cfm

Professor Martin’s Links

For Martin’s hand-picked links on financial literacy articles dealing with living on a low income, credit cards, where to get financial advice, how to accrue wealth, etc., go to: lawschool.unm.edu/finlit/index.php .

Check out the news section in next week’s paper to read about what’s changing in New Mexico’s lending industry--it’s good for you, and bad for creditors.