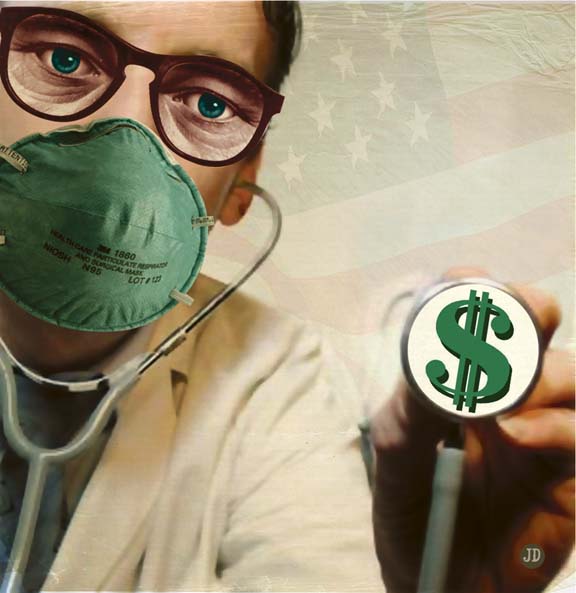

How Can I Avoid Medical Debt?

What Do I Do If The Bills Have Already Stacked Up?

Jeff Drew

Jeff Drew

Latest Article|September 3, 2020|Free

::Making Grown Men Cry Since 1992

Jeff Drew

Jeff Drew

Jeff Drew