Arts Interview: Creative Economy

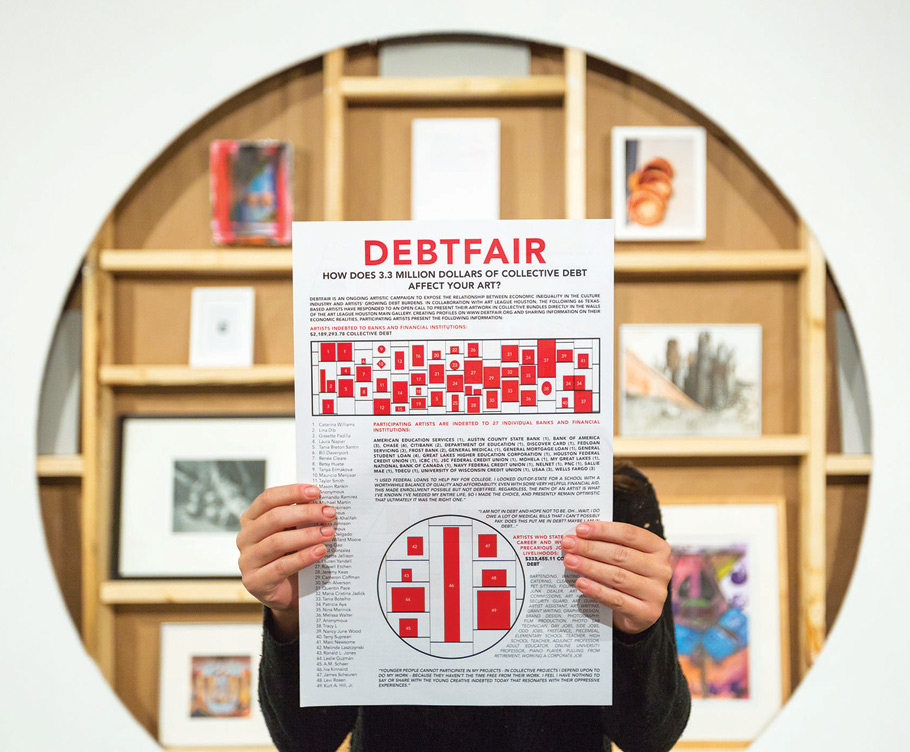

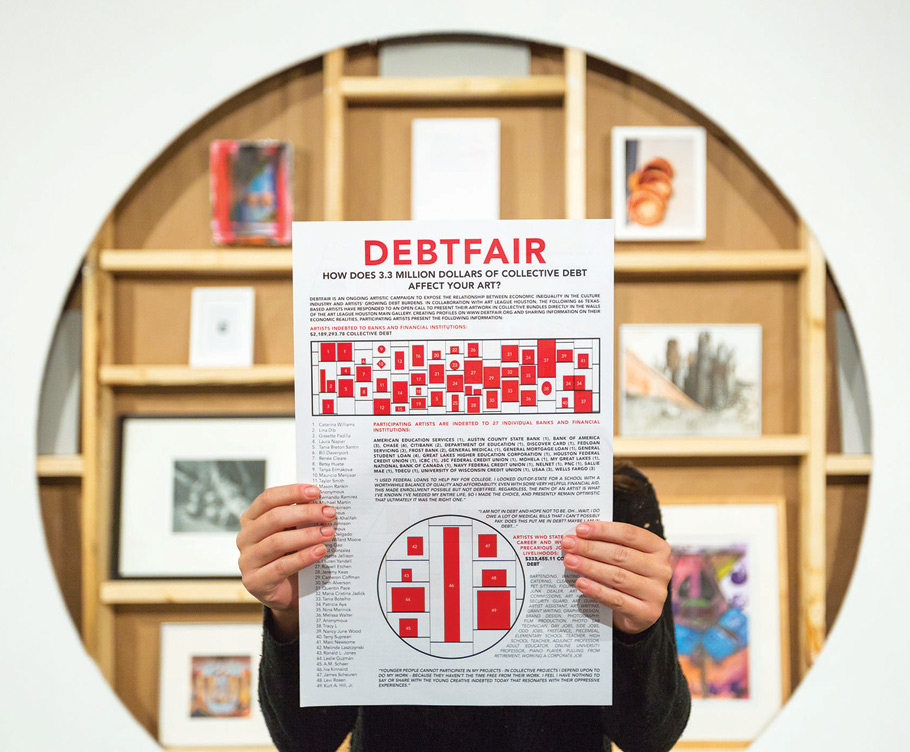

New Exhibition Asks Where Our Values Are

Debtfair speaks candidly to economic realities we all struggle with.

Tal Beery

Latest Article|September 3, 2020|Free

::Making Grown Men Cry Since 1992

Debtfair speaks candidly to economic realities we all struggle with.

Tal Beery